Digital transformation in the insurance industry.

As we head into 2024, there is a sense of cautious optimism in the insurance industry with regard to digital transformation and tech investments. This was our overarching impression from attending this year’s ITC Vegas, presented by McKinsey & Company, and appears to be a common thread throughout recent reports.

While geopolitical developments continue to breed uncertainty, only 15% of insurers see it as a barrier to growth according to Willis Towers Watson. Instead, insurers are more concerned with interest rate volatility and inflation (25% of respondents) and attracting talent (24%).

Digital transformation, of course, remains high on the agenda with 20% labeling it as their key priority. Despite the challenges, insurance companies that build security and risk-mitigation safeguard into their technological investments will end the year in a stronger position.

Here’s what insurers should keep in mind while developing their strategic approach for digital transformation in 2024.

Drilling down on digital transformation

The broad nature of digital transformation in insurance means that, while only 20% of the surveyed companies consider it a key priority, there is still a strong focus for the coming year. But where are insurers planning to concentrate their efforts within digital transformation and product deveopment?

Developing computing capabilities

Speakers and attendees at this year's in-person ITC Vegas event made evident that insurance technology development and computing as a whole is undergoing the biggest change in quite some time. For example, there will be a substantial increase in the size of AI models that are utilized across the value chain leading to a direct impact on performance and the quality of customer relationship interactions.

Advances in Generative AI caught the world’s attention with the release of ChatGPT, and Large Language Model (LLM) technology is continuing to redefine how insurers operate. According to the ITC, complex prompts such as “Write a letter explaining why there is no coverage for this claim” can now produce accurate texts.

The benefits of these emerging technologies, specifically Large Ai models, are still being discovered and developed by insurance comapnies. These models will eventually help with increased efficiency for operations like data analysis for underwriting, Actuarial analysis, relationship building with customers, customer winback automation, and cost reduction for administrative processes that can be automated with chatbots and other advanced automation systems. These Ai based technologies are expected to impact everything from customer service and sales to claims, IT, Finance, Legal & Compliance and beyond, and our prediction is that we’ll start seeing effective use cases in production for both medium and large companies in the first and second quarter of 2024.

A move to customer-centricity

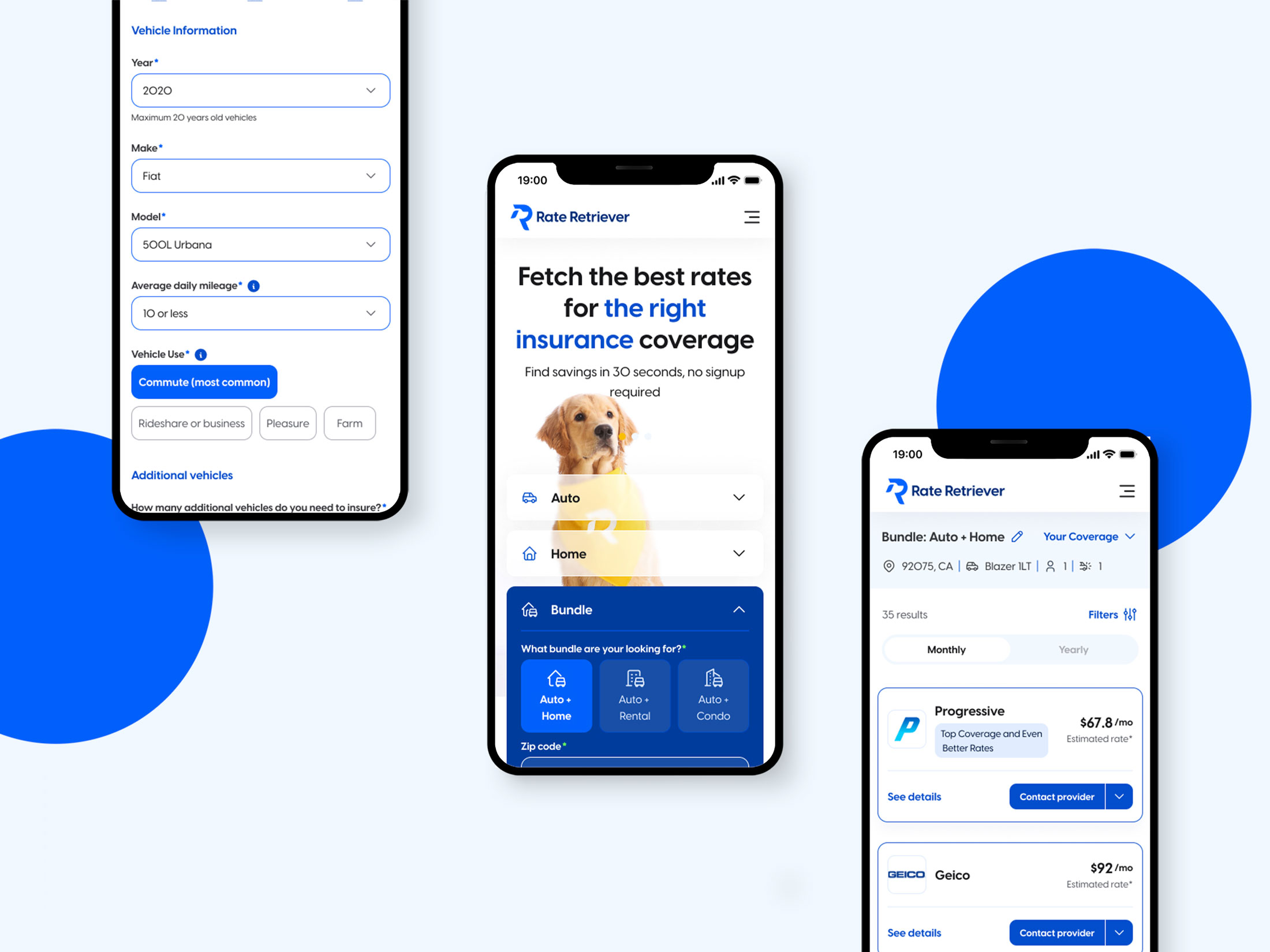

Tech-driven customer experience remains a key focus for insurance companies. A report by Attract Group claims that there will be a continued shift toward customer-centricity, with the quality of the experience across mobile applications, self-service tools, and other platforms paramount. Customers have little patience left for broken service experiences, especially in a complex sector like insurance where long processes are the norm.

However, the communication-led service experience alone isn’t enough to guarantee customer satisfaction. Insurtech startups are producing evermore innovative solutions, whether mobile apps, IoT devices, or blockchain technology to drive efficiency. For incumbent institutions in particular, there is a strong impulse to begin investing even more in innovative technologies now such as Artificial Intelligence, automation, and more.

In a separate report, Deloitte has come to the same conclusion, stating that, “This shift to a more customer-centric business model will likely require advanced technology adoption and modification of company culture to help minimize siloed interactions, enhance collaboration among employees, and increase accessibility of customer data.”

The need for rapid transformation in this area cannot be overstated. In fact, some organizations such as the ITC claim that traditional institutions are at risk due to their slow pace of transformation. More innovative market players or “disrupters” – characterized by their strong digital-first user experience – have reportedly “already won in some insurance markets.” For traditional incumbents to compete and regain market dominance, they need to offer a stronger digital experience to rival the newer players.

Risk, security, and compliance

The issue of risk is never far from the agenda with insurance companies. What’s more, the increased focus on data collection and management calls for a renewed focus on security.

The reason for this may be due to the heavy focus on compliance in 2023, which saw increased state activity according to Deloitte. Comparatively speaking, compliance may not be as high on the agenda in 2024, but insurers should still give it the attention it deserves.

Approaches to security and risk

Underwriting risks

The strategic approach to navigating risk is shifting, with greater emphasis placed on built-in risk prevention as part of the transformation initiative. As a Deloitte report says, “most insurers are realizing that reacting to risks may not be good enough and are undertaking transformation efforts aimed at preventing losses from happening in the first place.”

Software risks

Likewise, there is an increased interest in robust cybersecurity, which McKinsey highlights, saying, “companies today run on data, which makes cyber insecurity a major concern. An intrusion can not only disrupt business but also cause great harm to a company’s reputation.”

This furthers the case for investment in custom solutions that have been designed and hardened for particular firms or companies. With tailored solutions, insurers can benefit from enhanced usability, with fewer possibilities of security breaches or compliance issues.

The search for talent

Digital transformation acceleration is changing the ideal profile of new hires and creating new demands for upskilling and reskilling talent. By 2025, there could be an increase in labor productivity by around 35% thanks to AI and machine learning developments, giving employees more time to add value.

According to Deloitte, this context is creating an opportunity for insurers to “lead with purpose” and attract individuals with an equal interest in generating profitability and societal impact.

But attracting top talent of this nature is rooted in and dependent upon an insurance company’s ability to leverage technology that transforms both their internal processes and impacts the customer experience.

Barriers to success in the coming year

Despite the cautious optimism present in the market, there exist a number of barriers to digital transformation in insurance.

Complex business models

A key challenge for insurance companies is the inherent complexity of their business models. When seeking to deploy new technologies, these complexities can slow progress. Many companies are taking steps to reduce these friction points to deployment through fintech enablement platforms, according to InsurTech Digital.

Fragmented customer journeys

Fragmented customer journeys remain a challenge for insurance companies, even after technological investments have been made. The nature of insurance makes it touchpoint-heavy, with customers having to interact with agents, brokers, call centers, etc.

For this reason, integration and interoperability needs to be a key consideration for insurance companies with every investment. Technological investments, if they result in a siloed experience, will struggle to fulfill their function and deliver on customer expectations.

Overcoming the industry’s “image” problem

Insurers need to attract younger generations if they are to maintain relevance, brand image, and attract new customers of the younger generation. However, there is currently a disconnect between insurance companies’ image and younger expectations. According to WeForum, 75% of Gen Zers would choose to buy products that are sustainable, and this includes insurance.

This barrier is fully linked to the upcoming trend of attracting new talent and can be seen as an opportunity for growth as a challenge to overcome, as Deloitte highlights in their 2024 report and Forrester make reference to in an article on inclusive insurance. New technological investments can help attract more purpose-driven talent. This influx of talent can then work to change the perception of insurance and appeal to younger members.

What should insurers focus on in 2024?

When it comes to digital investments, insurance companies in 2024 need to take a strategic approach that takes into account customer centricity, security and compliance, and the evolving workforce.

While the specter of geopolitical unrest and unpredictable interest rates remain a concern, these short-term risks shouldn’t deter firms from making key long-term technological investments. Firms that fail to fully lean into a customer-centric business model with greater emphasis on value-driven products will find it difficult to thrive in years to come.

These technological investments and image updates are essential to not only connect with younger customers on an ethical level and to improve the customer experience, but are also instrumental in attracting top talent moving forward.

If you are interested in developing custom solutions for your insurance firm in 2024 and would like a digital transformation partner, reach out to us today. At Asymm, we work with you to design and develop strategic solutions that are tailored to your specific business context.