We create customer-centric user experiences to generate trust in digital insurance

Websites serve as crucial touchpoints for insurance companies to connect with their current and potential customers. But not all websites are created equal and accomplish what they can. The quality of the experience significantly influences the conversion of new clients and the retention of existing ones.

This importance extends across every stage of the customer journey, from initial research to product selection, problem resolution, and even when navigating the claims process.

Given the paramount role that websites play, it's imperative for insurance companies to strike the ideal equilibrium between user-friendly design, security, and functionality. So, what key considerations should insurance companies bear in mind to attain this balance?

Initial customer acquisition

According to Forbes, 47% of users won’t wait more than two seconds for a website to load, the average time visitors spend on a page is 54 seconds, and 88% won’t return to a site if they’ve had a bad experience. This is just as true for insurance companies as it is for any other organizations.

However, speed alone isn’t the defining factor in what visitors look for. A recent Deloitte survey focused on the US insurance market found that around 43% of Gen Y and 36% of Gen X respondents said they consider it “very desirable to buy personal lines through a website that not only offers do-it-yourself capabilities but also provides advice on what coverage to buy.”

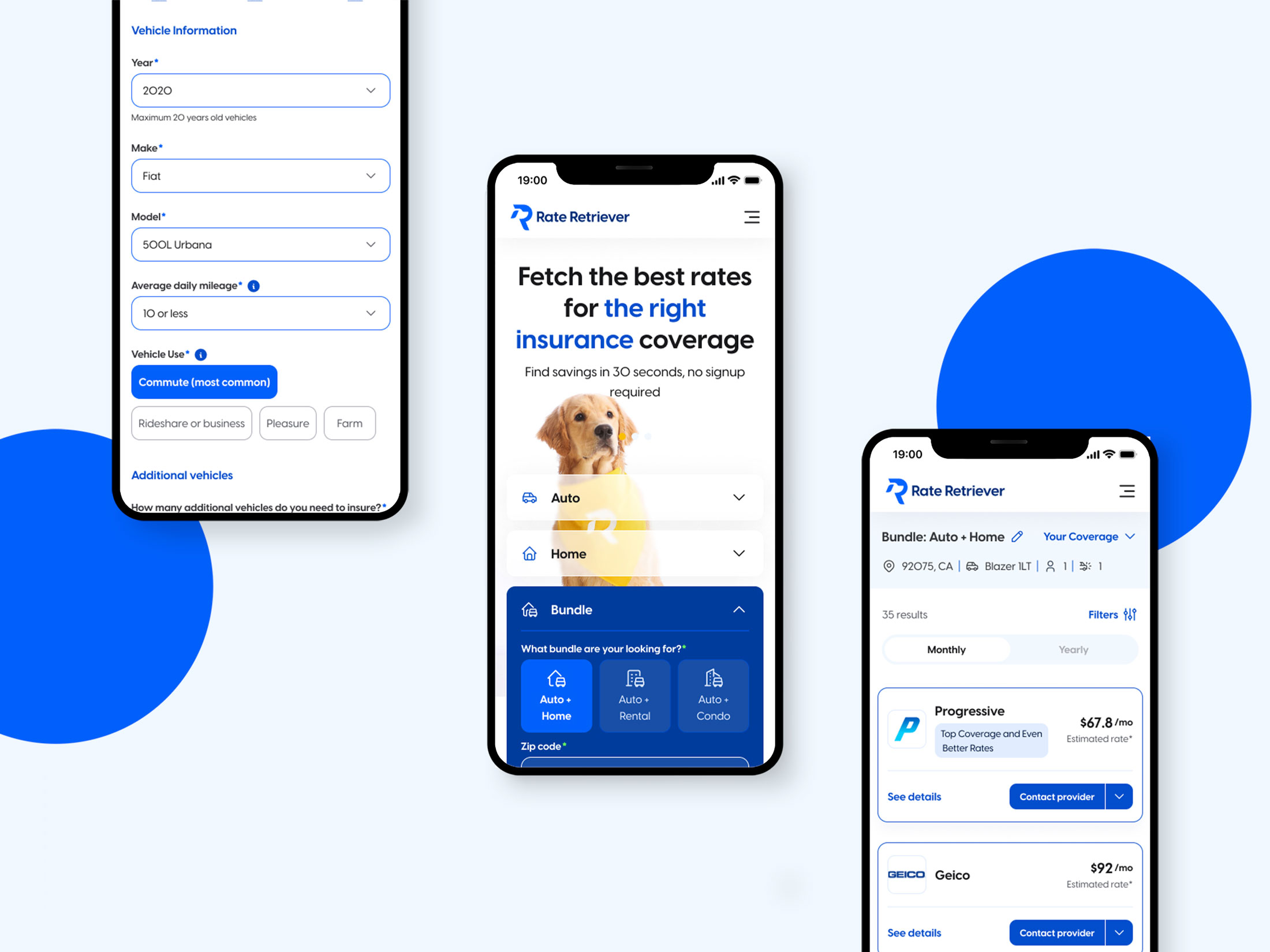

Having a website that is quick and easy to navigate is simply a baseline for insurance companies. Beyond this, they need to provide tools to understand coverage options, quotes, and generate a sense of trust to boost conversions.

Take Germany’s largest fully digital direct insurer, HUK24, which prides itself on being a “personalized insurance engine.” The business model revolves around supplying a fully automated customer journey through a convenient and tailored data-driven experience to enable “quicker and simpler interactions and ensure each customer gets the most suitable product in line with his or her individual situation.”

HUK24 has taken this idea as far as it can go, similar to fintech companies competing with incumbent banks. However, over 80% of insurance products are still sold offline – which is not what customers want. As a result, the strength of a streamlined online experience, particularly on the website, represents a lot of untapped value for insurers of all types.

Ongoing customer support (and retention)

The experience customers get when they interact with an insurance provider’s support channels must be excellent, particularly when it comes to resolving issues. A McKinsey report found that customer experience is “a strong predictor and driver of financial and organizational outcomes.”

It’s true that delivering a strong support experience goes beyond the website itself, with convenient omnichannel capabilities a prerequisite for service success. However, these channels don’t exist in isolation from the website and must be easily accessible at all times.

Insurance companies that offer just a phone number for support cases will find it challenging to deliver efficient or satisfactory resolutions that drive loyalty. The design of the website is key in this, as it represents the key first point of contact and must provide customers with direct routes of access to support staff.

A Deloitte report sums this concept up well, stating “A good customer experience at point of sale is only a starting point. The entire customer journey and UX/UI design must be considered” – and the website should be at the center of this.

The claims experience

According to a McKinsey report, having robust, digital-first software solutions can double profits over five years for larger incumbents. For all companies in the insurance sector, they claim that automation can reduce the cost of a claims journey by as much as 30%.

The website remains the first point of contact for many individuals looking to make a claim, with mobile portals, mobile applications, or other custom software solutions also available. But what does this claim process look like?

A standard claims process

No two claims are exactly the same, but they often follow a specific process that features around five steps. For example, a customer may have to:

- Contact their broker. The broker will need a list of the items that have been damaged or other relevant information depending on the type of claim being made.

- Claim investigation. Following the initial claim, a customer must wait for the investigation to take place. This can take some time, particularly if multiple parties are involved and there is a question of liability.

- Policy review. After the investigation has been concluded, the adjuster will need to examine the claimant’s policy to identify what is covered by the insurer and what isn’t.

- Damage evaluation. If we’re talking about auto insurance, property insurance, or anything else related to valuable objects, the provider needs to then undergo a value assessment. This may involve hiring appraisers, engineers, contractors or other experts.

- Final payment. Once the process has been completed, the claim will be settled and payment will be made.

What can insurance providers do?

This process will likely change depending on the type of insurance, but every provider will need some kind of process. What’s more, every process will feature friction sticking points or lead to frustration on the customer end.

The question is, what can insurance providers do to improve the quality of the claims process? Much of the potential frustration can be mitigated through robust website tools and strong communication – as can be seen with Asymm’s work with NOW insurance.

Robust website security

Insurance fraud is a substantial problem in the United States, costing roughly 309 billion dollars annually. This is a more delicate challenge than it may appear for insurers. As insurance companies want to attract new customers, having a system that flags legitimate inquiries will undoubtedly lead to fewer conversions. As Forrester reports, on the opposite end of the spectrum, by accepting all customers, insurers open themselves up to more risk.

And the risk can spread from the insurer to customers, particularly when you take the issue of data security into account. Any sensitive information that clients enter into the system, whether financial data or transactional records, must be protected.

If there are any breaches in payment processing systems, for example, this could lead to fraudulent transactions, which harms the institution and the customer financially and also severely damages trust.

For insurance companies considering creating or updating their website, there is simply no room for error when it comes to security and having a fully hardened website is a key part of this. The best way to achieve this is through custom website design.

Creating a custom, well-rounded website

What insurance companies need from a website goes beyond your average business or organization. It of course needs to be flexible, user friendly, scalable and offer a distinct competitive advantage. But beyond this, it also needs to take into account security, regulatory compliance, and the substantial issue of risk.

With so much to consider, it can be difficult for standard platforms to deliver on the balance between tailored customer experiences and security. To get a product that truly performs, from first customer contact to ongoing support or upsells, it is better to get a custom-built platform.

Custom insurance website design with Asymm

As a custom software developer, Asymm is well positioned to help insurance companies with their website design. Our expertise in creating custom software solutions means that we can deliver any functionality that an insurance provider needs.

This may be on the website or a complementary asset like an application, B2B SaaS products, internal software tools, or more.

But beyond our technological expertise, we specialize in being full digital transformation partners. This means we will sit down with you to discuss your needs and come up with the right strategic approach for your company to ensure that all function and design aspects are covered.

If you’d like to find out more about what this looks like, get in touch with us today to schedule a call.