Overcome Insurance Challenges Through Insurtech Solutions

Finding the right software provider can be a challenge for insurance companies. Once the research phase begins, it’s common to find that none of the solutions on offer quite meet the required needs.

This may be for broker portals, underwriting software, claims management solutions, a high-performance website or app, or software to address any of the specific functions that individual insurance companies require.

That’s not to say that various out-of-the-box solutions are entirely unfit for purpose, but there may be either unnecessary, potentially costly features or a lack of relevant features to guarantee ROI. This is particularly important for insurance companies which, according to global trends, are struggling with current market forces and need tools that align with their strategic approaches.

Let’s put it this way, if an insurance company is considering investing in software, it is essential that the solution performs exactly as intended to maximize conversions, efficiency, or savings due to reduced manual labor – something that is certainly possible with customized insurance software development.

Global trends: The state of insurance

Insurance companies are undoubtedly a force to be reckoned with in the US and beyond. In total, there are 5,954 companies in the United States employing a total of 2.86 million individuals.

However, despite their prominence, the profit margin for insurance companies was only 3-5% on average. If we look globally, most insurers actually incurred substantial real investment losses in 2022 as they battled with the impact of inflation, increased claims and losses, and rising interest rates which affected fixed long term holdings.

This price pressure has also had an impact on the cost of servicing claims. A McKinsey report found that for property and casualty insurers, rising prices led to a 30 billion dollar increase to cover claims in 2022 compared with 2021. The same holds true for all types of insurance companies, which need to increase their premiums to cover rising costs.

While insurance companies certainly have their challenges across their operational value chain, there are also problems to solve these various issues through investment and R&D. Generally speaking, when things get more expensive, a company has to become more efficient.

What software do insurance companies need?

Every insurance company has wide-ranging needs when it comes to software, and yet the market has been slower to embrace digital transformation than others. According to Insider Intelligence, insurers fear “failing at a time when the stakes behind attracting customers are high.”

The fact is, as millennials take over from older generations as the largest purchasers of insurance, the companies need to have a robust technological system in place to meet the expectations of this digitally fluent demographic.

This can cover a broad range of tasks. Not only do insurers need to update or manage customer policies or process claims, but there is also substantial work involved with managing teams, vendors, and general ongoing customer service requirements.

And that’s without even mentioning the substantial customer outreach efforts that are necessary to secure new business. For example, 16% of US customers claim to need life insurance but don’t currently have it, representing 41 million untapped customers.

The strategy behind customized insurance software development

It’s important to recognize that no two insurance firms are the same. While any of the above software solutions could be useful to an insurer, the real-world needs depend on a range of factors.

This could be the type of insurance offered – for example, the 3-5% average industry profit margin does not hold true for property and casualty premiums, which operate at 23.26% profitability. It stands to reason then that the software needs for one insurance niche differs from another depending on what their unique problems are. Here are a few guidelines to identifying the problems you could potentially solve with specific insurance software project development:

1. Identify your own market need

Regardless of the firm, the first step is to always identify your strategic focus based on the insurance type and market niche.

For example,If you’re a P&C insurer or MGA, your need might be to create a dashboard that visualizes your assets and insureds, or possibly a portal for you insureds to interact and increase their coverage more seamlessly.

The gaps in the market for insurance companies can be so specific that there isn’t a ready-made software solution that can perform as needed. While this is just the first step, it is generally the deciding factor as to whether you would benefit from a custom solution developed using a digital transformation partner.

2. Consider your customers’ preferences

Developing custom software isn’t just about ensuring operational needs, it also needs to appeal to current or potential customers. This means understanding how your customers behave and factoring that into your software solution.

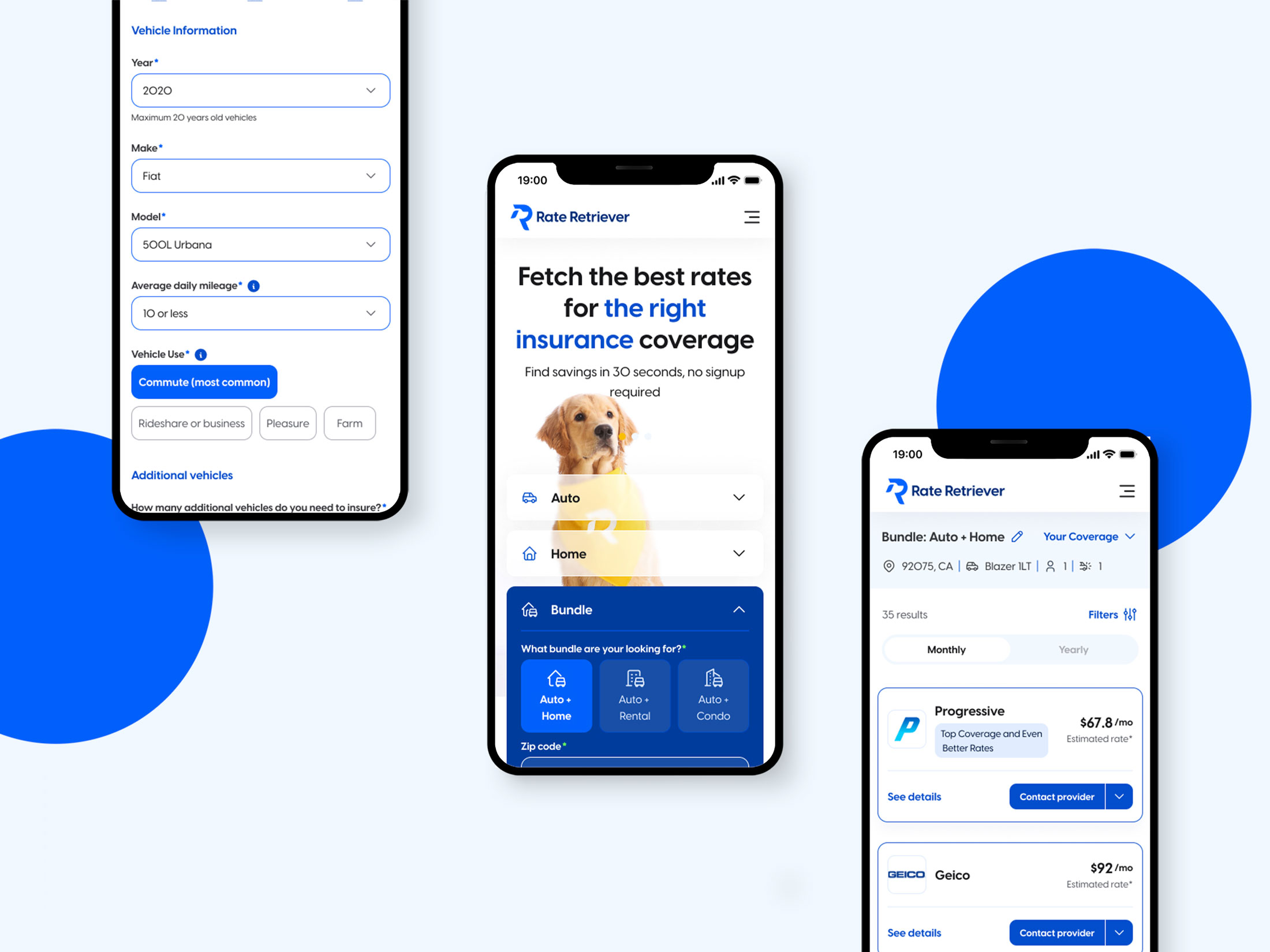

For example, there has been a trend since 2020 of increased mobile queries that contain “insurance near me” – with a 100% increase recorded in just two years. This tells us that mobile-first approaches could be more profitable and a firm may benefit from investing in a mobile app.

That said, statistics show that inbound calls is the most valuable channel for actual conversions. If this is true for your company, it is important that you provide a seamless, user-friendly means of contacting you directly from a great website, as an example. .

Whatever preferences your customers show need to be incorporated into your software solution and overall insurance digital strategy.

3. How secure is your software?

Globally, the cost of cybercrime is predicted to cost 13.82 trillion dollars by 2028. It simply does not matter if your software is fully functional and entirely user friendly if it doesn’t also meet stringent security requirements.

They say the best defense is offense and this couldn’t be more true than with cybersecurity. With custom insurance software, you can plan to build in safeguards and more robust practices to guarantee the security of your customers and organization.

4. Audit your current systems

Investing in custom software isn’t just a matter of adding to your current tech stack. It’s a chance to migrate and consolidate current tools to reach a higher level of cost effectiveness and systems efficiency.

Since you have complete control over the development of your software, you can identify single-function tools that you currently pay for, which can be incorporated into the new tool or platform.

Maybe you’re paying for a calendar extension or communication channels, or using a payments system that is outdated. Alternatively, you could be taking care of internal organization with a light CRM tool, and upgrading to enterprise quality and a modular payment processing system. There are any number of areas where you could consolidate legacy systems and promote cost-effective operational efficiency.

How custom solutions drive ROI

When it comes to custom insurance solutions vs. out-of-the-box alternatives, there are specific reasons why the custom solution achieves increased ROI. Moreover, these reasons hold true regardless of the specific solution you need – whether broker portals, CRM, claims management or more.

Initial implementation

At first, the initial implementation of a platform solution will likely be quicker and may require lower initial investments when compared to custom development.

However, what you gain in initial speed, you will lose in ongoing performance indicators that are essential to achieve ROI. For example, with a custom solution, you will have no limits to access specific functions and an easier time scaling the software as your company grows. There will also be more iterative releases that are specific to your needs to drive faster payback, as well as a better UX and UI experience for ongoing usage.

The limitations of platform solutions

When you compare these specific aspects with a custom solution, you will find them harder to scale, limited integration potential and customization capabilities, particularly with business-specific functionalities.

Overall, according to a McKinsey report, the potential benefits of effective digital modernization can result in a 40% reduction in IT costs alongside an equal increase (40%) in operations productivity. This has been shown to lead to more accurate claims handling, and even increased gross written premiums – as well as reduced churn.

Is Asymm the right partner for you?

At Asymm, we support insurance companies in developing a wide range of software solutions that are specific to their needs. We don’t operate on a one-size-fits all approach, instead taking the time to get to know your company and determine the best software for you.

It’s this approach that has led to us developing everything from mobile applications for insurance companies to websites to policy management tools. Backed by a nearshore team of experienced developers and project managers, we offer the highest quality software available that’s tailored to you.

To find out more about our customized insurance software development solutions for your company, reach out to us today.