About the company

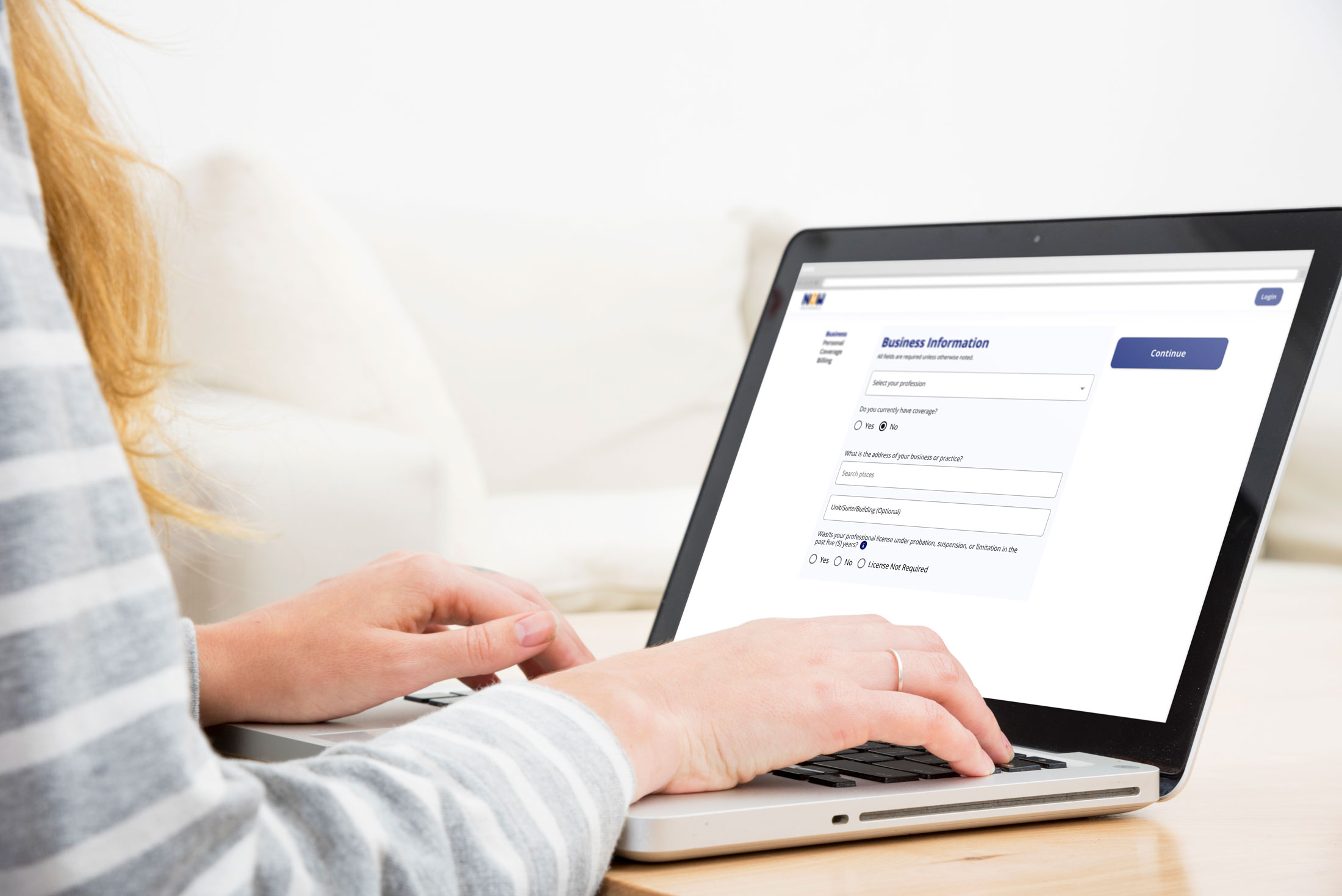

Now Insurance provides liability coverage to a range of medical professionals and practitioners. Founded in 2018, NOW insurance is a digital managing general agency (MGA) that provides coverage through its digital broker portal and direct to consumer automated underwriting processes. Through its advanced underwriting capabilities, digitized policy management system, unique market position, and coverage options, NOW insurance has positioned itself as one of the leading medical Insurtechs in the industry - best known for its ability to write challenging classes of business by leveraging technology, data, and insights.

The challenge

As a startup, NOW Insurance developed a product roadmap that outlined parallel business and technology objectives to distinguish itself as an advanced digital MGA in the medical professional liability vertical. Asymm was brought on to facilitate technical product development through the development of large scale features for the NOW platform. Here are a few of the key distinguishing features and capabilities of the NOW platform that Asymm helped develop and refine:

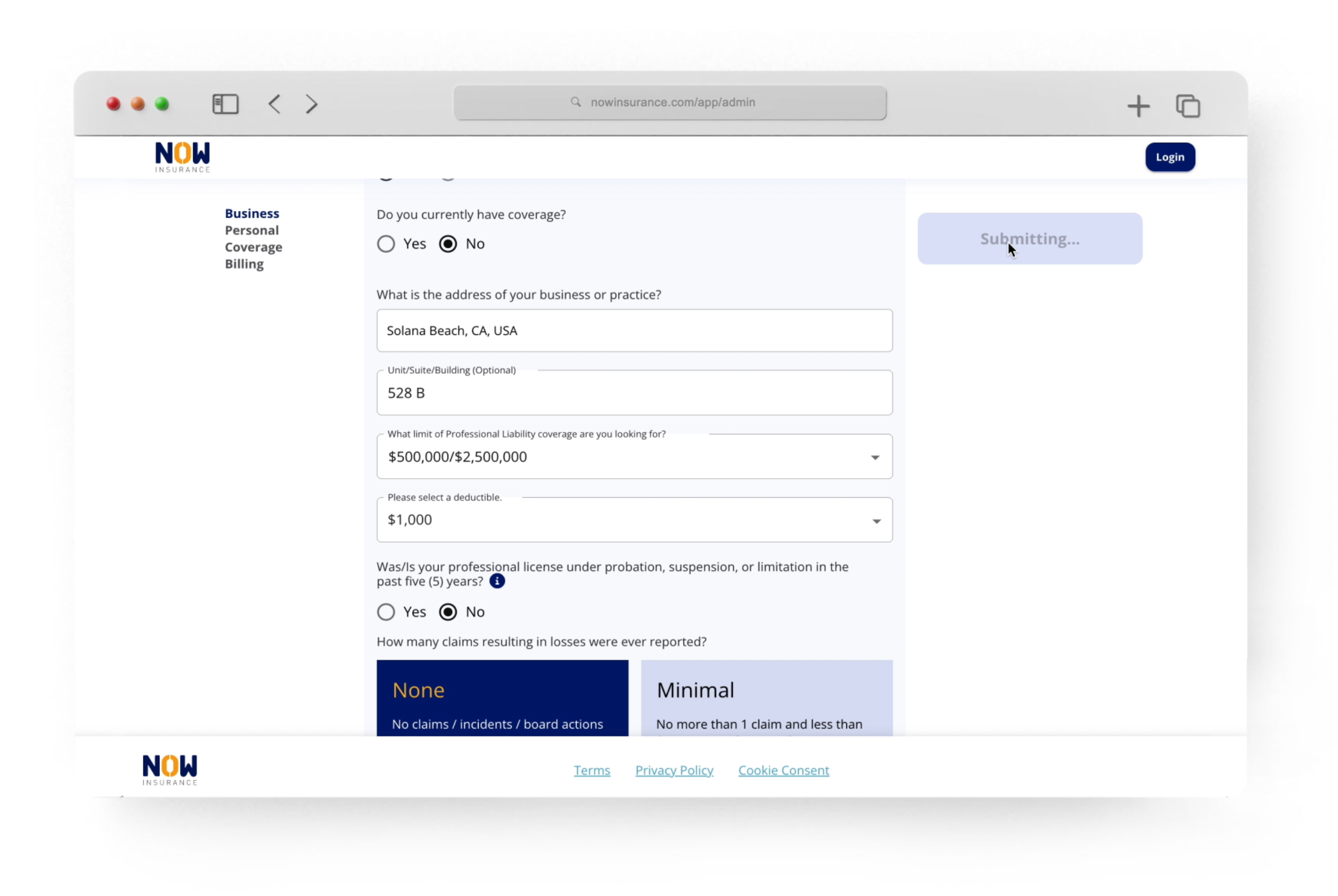

Programmatic underwriting

Policy delivery and policy lifecycle management

Custom service integrations and processes

Third Party data integrations

Payment processing, integrations, and data synchronization

The processes

Through our multi-year engagement with NOW insurance, we’ve been able to consistently develop and deploy new features for their platform. Our engagement with NOW was structured as a an outsourced software product development team, consisting of two full-stack engineers, a dedicated project manager, a dedicated QA lead, and a quality assurance engineer that worked directly with their in-house product management team to scope, define, and build features essential for their sales, marketing, customer service, and underwriting teams. Our software development team followed an agile model and structured the engagement with revolving two week sprints that prioritized features, epics, and bugs across their organizational units and respective priorities.

The solutions

NOW’s platform is a solution to a large problem within the specialty insurance industry - lack of technological adoption for increased efficiencies and performance. Through the development of key features, NOW is able to write high volumes of professional liability policies with low overhead and consistent underwriting guidelines and pricing, meanwhile maintaining competitive rates and loss ratios.

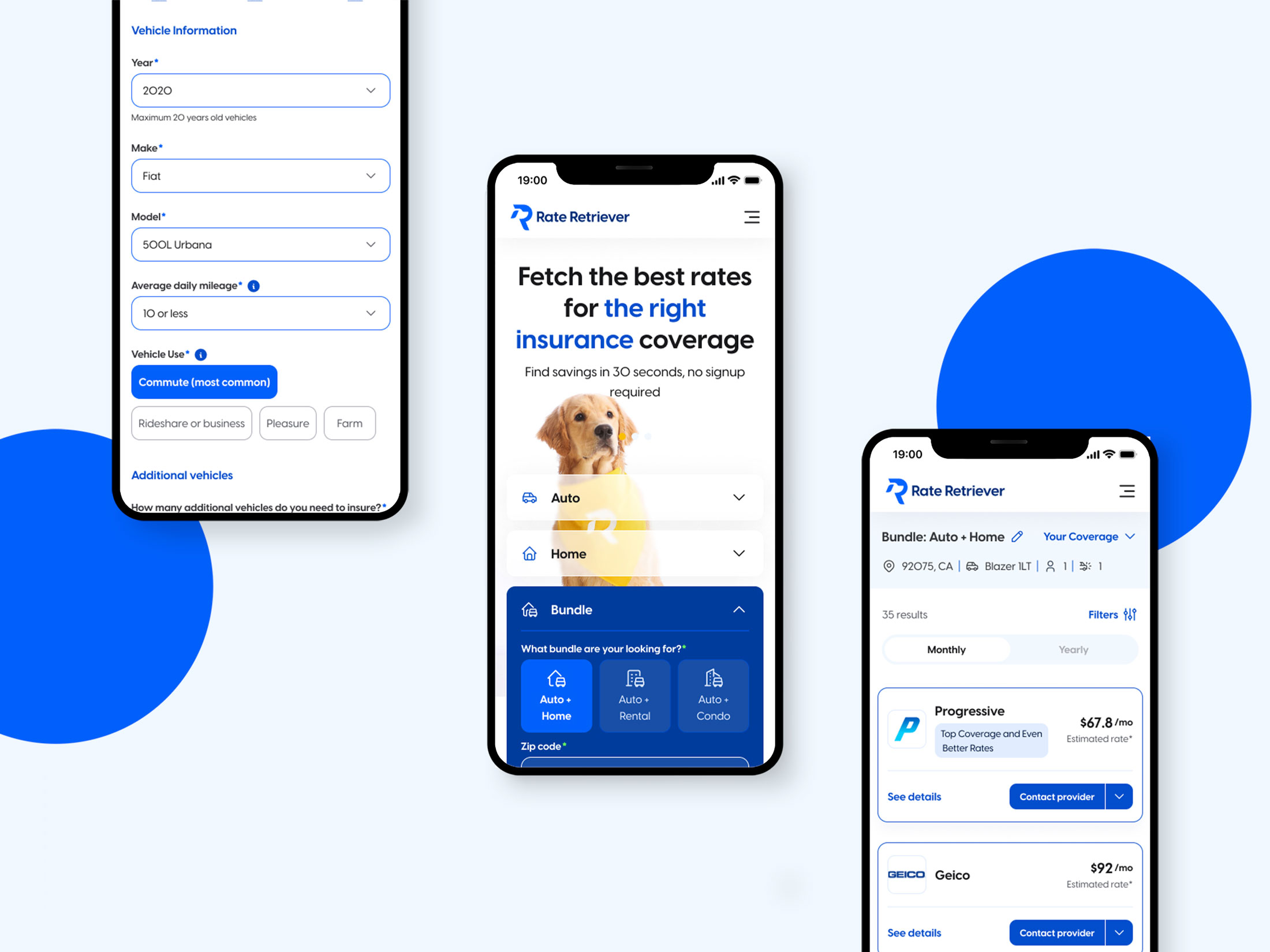

By adopting a technology driven approach, NOW is able to sell insurance directly to its insured and also through its broker network. By focusing on developing a differentiated and improved user experience for professionals and brokers looking to distribute commercial liability insurance while also maintaining strong insurance fundamentals, NOW has built technology enabled insurance products that will drive new business, partnerships, and long term growth.

Technologies

React JS

Ruby on Rails

SQL

Hubspot

Stripe

AWS

Our impact

Through our long term engagement with NOW Insurance, they’ve been able to fundraise over $4 Million USD and grow their business through several key metrics including their user base, gross written premium, annual recurring revenue, and ability to write new classes of professional liability insurance. The development of new features and products for their platform has in-part enabled them to raise capital, develop reinsurance relationships, develop new insurance products and grow their business through customer acquisition.