Data security and compliance is an increasingly important issue for insurance companies. It seems that with every year, there is more for organizations to contend with – whether cybersecurity threats, regulatory compliance, data management, or dealing with customer privacy concerns.

While overcoming these challenges is an ongoing strategic issue for insurance firms, it is particularly difficult when deciding to invest in a new software solution. Technology is changing rapidly and with every new asset they acquire, companies need to ensure their security and compliance remains robust – and that means investing in custom software solutions.

Today’s security and compliance challenges

It is no exaggeration to say that insurance software companies are facing a complex landscape when it comes to security and compliance. Cybersecurity attacks are on the rise, costing organizations nearly $8 trillion globally in 2023.

On top of this, organizations – particularly in the insurance sector – need to adhere to regulatory compliance requirements, whether the General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA) in the US or more worldwide.

With these realities further compounded by the challenges of handling large amounts of data and maintaining trust over customer privacy concerns, there is little room for error.

Managing consumer expectations

Of course, insurance companies need to balance these risks with providing a standout service for customers. Studies show that 46% of customers believe that the experience they will receive is an important factor when choosing an insurance provider. However, only 18% claimed that their experiences with insurers were “excellent”.

What’s more, 34% claim that they prefer to use a mobile app for policy claims, payments, and disbursements – a number that is set to grow as expectations change. And it pays for insurers to get on board with these developments.

As McKinsey reports, “customer experience is a strong predictor and driver of financial and organizational outcomes.” Overall, insurers classified as CX leaders outperformed their competitors by 20% from 2017 to 2022. They demonstrated stronger revenue growth, lower expenses, and higher employee satisfaction scores.

Can custom software improve security?

It’s important to note that software alone isn’t enough to guarantee security. In fact, internal vulnerabilities, particularly human error, are a leading cause of unauthorized entry. If employees haven’t been properly trained, they may fall for messaging scams or similar phishing tactics.

These methods are becoming more sophisticated, with emails or websites appearing so legitimate that unwitting employees accidentally download a virus or compromise sensitive data.

For this reason, the emphasis should always be on a robust security strategy and consistent ongoing training. That said, the quality of your software does play a role in security and compliance in a number of areas.

Security through obscurity

Even the most robust software solution can be broken into if enough bad actors target it. Take the popular Content Management System WordPress as an example. WordPress is an exceptionally strong platform and yet has to deal with around 90,000 attacks per minute, resulting in 1 in 25 breaches in 2021.

The reason for this is largely due to WordPress popularity. As a rule of thumb, the more well known a platform is, the more hackers will target it. Custom software, however, is more likely to fly under the radar of hackers as there are fewer opportunities to find you in the first place.

Less worth their while

As an insurance company, you will be spending a lot of time and effort on promotion, marketing, and other awareness strategies. It is likely that at some point an individual or clandestine organization with bad intentions will come across your company.

Even then, if you have custom software, it is less worth their while to attempt an attack on your business. The reason for this is the software has been tailored to your business, with deliberate structuring and scaling features built in. When compared with an off-the-shelf alternative, the chances of reward for hacking into the system are simply lower.

Custom functionalities

What does your software need to achieve? It could be improved efficiency, customer experience, data management, scalability, flexibility, adherence to regulations, or more.

In other words, it is entirely up to you what you want your software solution to do. For example, if you are investing in claims management software, during the project scope stage you can outline your concerns. This could involve detecting claim frauds or ensuring data management for compliance.

Your solution development partner can then work with you to develop software that meets your specific needs. As these custom functionalities have been made exactly for you, they are more robust.

Custom insurance software examples

At Asymm, we specialize in developing custom software solutions that are effective, high-performant, and secure. By working closely with our partners, we ensure that they get access to robust, future-proof tools.

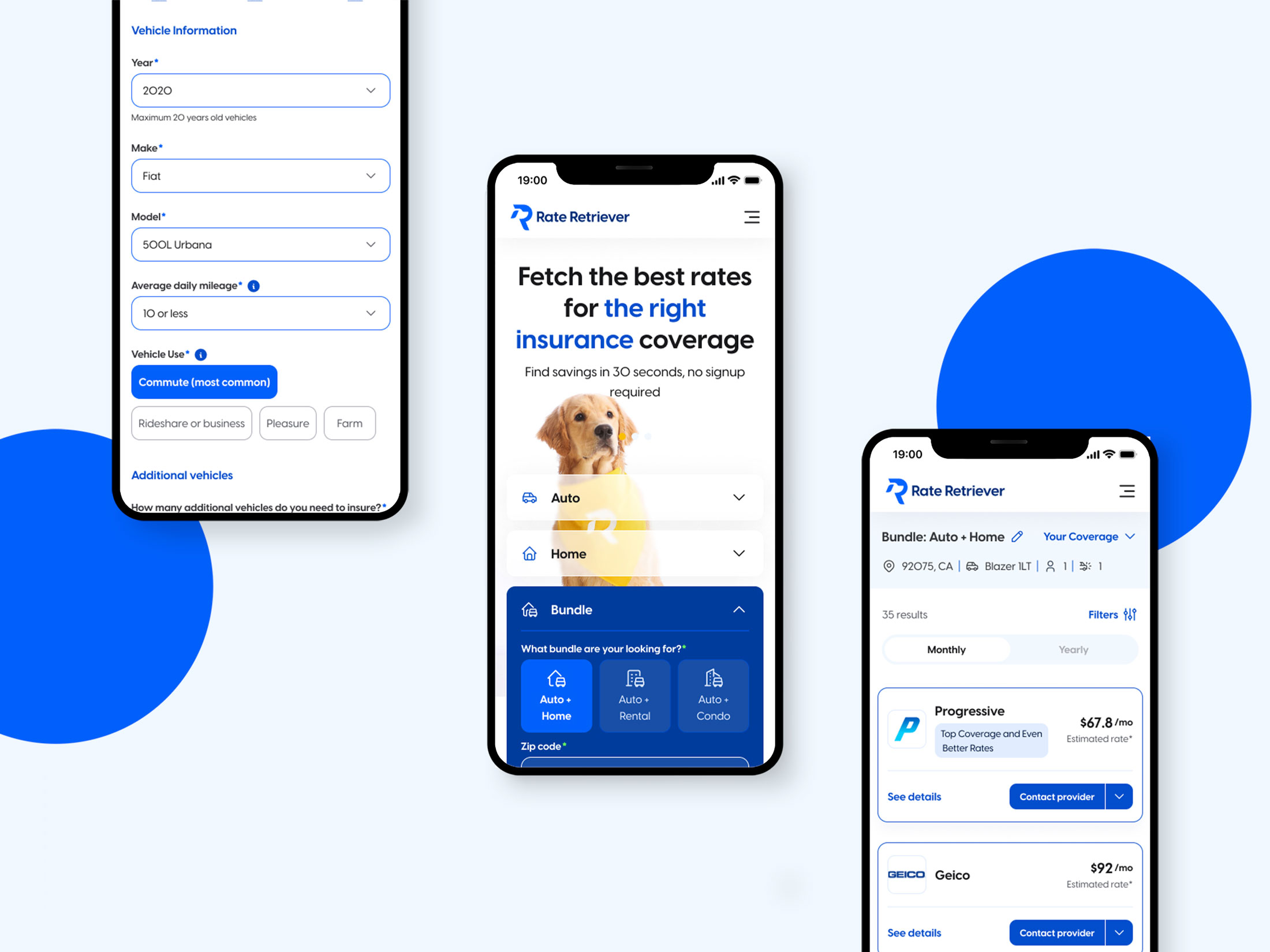

Rate Retriever

One example of this was our work with the insurance comparison platform Rate Retriever. At Asymm, we helped the platform provider to refine their front-end experience to communicate rates efficiently to the user.

As part of this, the customer has to provide their personal information so the rate they get reflects the coverage they are shopping for. While the primary goal of the project was user experience, our team took a mobile-first approach that followed best practices at all times. In the end, not only did Rate Retriever get a fully redesigned UI/UX for their insurance comparison platform – but they had the confidence to know that their customers’ data was safe and secure.

NOW Insurance

NOW Insurance is another company that the team at Asymm worked with, specializing in liability coverage to a range of medical professionals and practitioners. NOW insurance has positioned itself as one of the leading medical Insurtechs in the industry and works with challenging classes of business.

To deliver a project of this size – developing large-scale features for the NOW platform – the team needed to prioritize quality and security at every stage. This was achieved by bringing together a team of Asymm professionals, made up of two full-stack engineers, a project manager, a dedicated QA lead, and a quality assurance engineer.

The team worked together with the in-house project management team to ensure that each feature performed its function while minimizing any risk to the insurance company. In this time, NOW Insurance was able to raise over $4 Million USD and grow their business – partly due to the new features and products available on the platform.

Thinking of investing in custom insurance software?

There are many strategic considerations involved with investing in insurance software assets. But one thing is for certain – if you don’t take proper care of security and compliance, you will lose customer trust or open yourself up to unnecessary risk.

That’s why, for insurers that are considering investing in software, it’s essential to work with a partner that understands the full spectrum of your needs. From customer experience to functionalities to data management and beyond, you deserve a solution that meets your exact needs.

At Asymm, we specialize in working closely with insurance companies to develop tailored solutions for your specific context. From day one, we hands-on support and expertise to fully understand what you need and develop a plan to achieve it.

If you’d like to find out more, reach out to us and we’ll get back to you as soon as possible.