How Digital Transformation and Software development in Insurance is Reshaping the Industry and User Experience

The insurance industry has been around for centuries, and it's no secret that it’s been slow to embrace technological innovation. Traditionally, insurance companies have relied on manual processes, paperwork, and face-to-face interactions to conduct business. However, the rise of various new technologies and demand for product development is forcing insurers to rethink their traditional ways. The COVID-19 pandemic also accelerated the shift towards digital, as insurance companies were forced to adapt to shifting consumer demands and virtual customer interactions.

As a result, many insurers are now investing heavily in digital transformation initiatives to improve their competitiveness, efficiency, and agility. According to research by Accenture, 90% of insurance companies say that most consumers will purchase their products online within the next five years.

But digital transformation is not just about replacing legacy systems with new ones. It's a cultural shift that requires a change in mindset and a willingness to embrace new ways of doing things. While it's always been important for insurers to maintain a physical presence in their clients' communities, there has been a shift in the ways businesses access and sell to customers, especially younger demographics.. Now, when an insurance company wants to sell its products, it needs to do so with the help of digital channels. Hence, software development in insurance companies is now more critical than ever. By using the latest technologies and advanced APIs for insurance, companies can simplify their day-to-day work, make their customers happier, and even create new revenue streams through web and mobile based products.

In this post, we'll explore what digital transformation in insurance is all about, why it matters and identify key insurance software development topics that stakeholders and decision makers should take into account to stay ahead of the curve.

What Benefits Does Digital Transformation Bring for Insurance Companies?

In today's digital world, customers are looking for more than just coverage; they want a personalized experience that fits their unique needs.

Let’s look at Lemonade as an example, which operates entirely online. The company uses various technologies within their web based platform such as artificial intelligence and machine learning to analyze customer data and provide customized insurance policies in just a few minutes for verticals such as renters, pet, and auto. By simplifying and streamlining their quoting processes and tailoring their policies to individual needs, they’ve managed to attract a loyal customer base. As a result, their customer count increased by 30% in Q3 2022 compared to Q3 2021. Their premium per customer also has increased significantly, growing by 35% compared to the year before. While Lemonade has been said to have underwriting issues, there’s no question that their digital distribution and product development has been impressive in already established and crowded markets.

Lemonade's success in rapidly acquiring a significant market share can be largely attributed to their innovative digital marketing strategy, which targets younger demographics. Lemonade uses data-driven insights and social media platforms to target millennials and digital natives who value speed, simplicity, and transparency in their insurance experiences. Lemonade's easily navigable software platform allows customers to quickly and easily get quotes and file claims, creating a seamless user experience. With that kind of success potential in mind, let’s look at some of the benefits insurers can take advantage of through digital transformation:

Faster claims processing:

Digital transformation allows insurance companies to automate many of their manual processes, with one of the most important ones being claims processing. This not only improves efficiency, but also greatly increases customer satisfaction. Another key indicator of product success. While many insurers try to make claims processes cumbersome and long, modern digital insurers are more focussed on customer satisfaction and use it as a tool to drive product innovation to acquire more customers - centric to their growth strategy. While hyper growth for insurance companies has certainly led to poor underwriting, there is value in streamlining certain processes such as claims that do lead to long term customer retention, not to mention the efficiency benefits that digitization can provide.

A great example is Zurich North America. By adopting advanced automation technologies and developing significant web based infrastructure combined with artificial intelligence, Zurich was able to save 40,000 work hours by reducing many of their claims processes significantly. This dramatic improvement in speed not only saves time for the company, but also creates a better experience for customers who receive their claims payments much faster, ultimately leading to increased customer retention.

Reduced costs:

By digitizing and streamlining workflows, insurers can eliminate manual processes, reduce paperwork, and minimize the need for physical infrastructure.According to a study by Accenture, the insurance industry can achieve up to 30% cost savings by automating underwriting and claims processes through digital technologies such as developing automated processes that combine data collection, data processing, and automated decision making and flagging systems for low-stakes claims. By reducing the time and labor required for such tasks, insurers can free up resources to invest in other areas like innovation, product development, and customer service, ultimately driving growth through systems development.

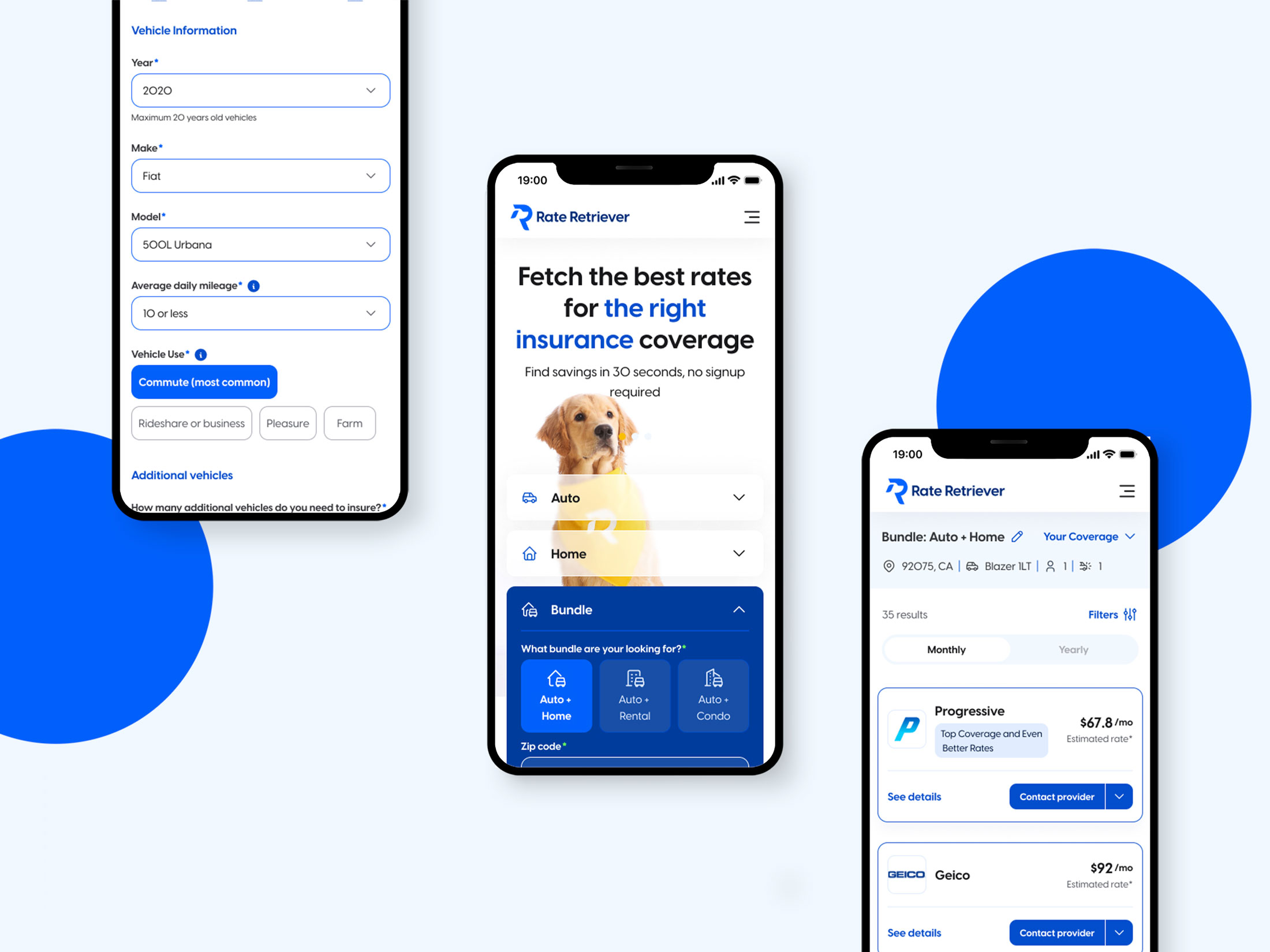

Improved user experience:

This is one of our favorite areas for digital insurance transformation. It’s no question that millennials are spending more and more time on their smartphones, and businesses are taking notice. Many insurers are starting to adopt the direct-to-consumer sales model, eliminating the need for insurance brokers. While brokers for many types of insurance are incredibly valuable and important, this evolving direct to consumer model provides customers with more convenient ways to get a quote, submit and manage their claims, policies, and other insurance details. People can use mobile apps and online portals to access their insurance information, pay bills, and manage their policies, making the entire process of self-service policy management more efficient. According to McKinsey, over 90% of multi-channel insurers now offer their customers online access to their insurance products, increasing reach and accessibility.

Insurance products are also being embedded into online and physical purchases, making it easier than ever for consumers to access coverage. This changing landscape has led to the emergence of new insurance companies that are specifically designed to meet the changing demands of consumers who expect a more user-friendly experience.

Improved distribution:

The rise of digital platforms and mobile technologies has led to the emergence of new distribution models like embedded insurance, which involves integrating insurance products into the purchase process of other products and services, such as a flight, a car or a phone. Instead of searching for insurance policies from various providers and navigating through different websites and apps, customers can easily purchase insurance while completing their primary transaction. This approach is gaining traction within the insurance ecosystem due to its convenience and ability to reach customers at the point of need.

Insurers are also leveraging digital platforms to offer their products in new and innovative ways. Artificial intelligence and machine learning is being used to personalize the customer experience and provide targeted product recommendations, enabling customers to purchase policies with just a few clicks. These innovative distribution methods have not only made insurance more accessible but have also provided new revenue streams for businesses partnering with insurance providers.

What's Next for Insurers?

Insurance companies are trying to keep up with the latest trends in software and data to stay ahead in a highly competitive industry and understand a changing world and better calculate and manage risk profiles, distribution channels, shifting customer preferences, and other variables that directly affect premiums,losses, and their distribution.

Notably legacy insurers can most easily modernize through the development of modern software that’s performant and can be scaled to serve diverse customer needs. We’ve identified high value projects as modernizing policy administration systems, building advanced web applications, developing mobile applications, and other resources that both customers and administrators alike can utilize to drive efficiencies and satisfy customer demands.

In today's digital age, customers expect a seamless experience across all touchpoints, whether it's through a website, mobile app, or a call center. To meet these expectations, high-quality software development in insurance is a must. Companies need to make sure their digital platforms are user-friendly and intuitive, making it easy for customers to access information, manage their policies, and file claims. By focusing on their experience, insurers can improve customer satisfaction and loyalty, which can translate into increased revenue and long-term sustainable premium growth.

Another advanced trend that will continue to be important in the future is the use of data analytics and artificial intelligence. By leveraging these technologies, insurers can gain valuable insights into customer behavior and preferences, which can help them develop new products and services tailored to individual customers. While there are nearly endless applications of investing into sophisticated data tools and artificial intelligence powered applications, a few forecasted additional benefits to insurers of developing these tools include helping insurers automate manual processes, improve customer service through automation, advanced fraud detection, and improving underwriting through leveraging larger actuarial data sets and more sophisticated analysis.

Another exciting technology that's gaining traction in the insurance industry is the use of blockchain technology. While many are opposed to the adoption of anything to do with Web3 because of blockchain in the context of cryptocurrencies, some insurers have started adopting blockchain technologies and implementing them within their applications and products. In insurance, it is fairly well understood that blockchain can be used to securely store and share data, streamline claims processing, and prevent fraud. However, as we know insurance is a slow-moving industry and we don’t expect this to become mainstream anytime soon, especially with the regression of web3 due to several exchange crashes and fraudulent events over the past year.

With that being said, It's an exciting time to be in the insurance industry, and the possibilities for innovation are nearly endless. By keeping up with modernizing technology and adapting accordingly, Insurance businesses can avoid accumulating technical debt, and continually work towards offering customers more of what they want and build long term relationships - one of the pinnacles of success within insurance.

How Companies Can Leverage Software Developers in Insurance

Many companies are now recognizing the need to outsource software development expertise to help them navigate this new landscape.A skilled software development team can help insurance companies develop custom solutions that meet their specific business needs, whether that involves streamlining internal workflows, improving customer experiences, or creating new revenue streams through innovative products and services.

Partnering with a software development firm can help insurance companies stay ahead of the curve when it comes to emerging technologies and industry trends. At Asymm, we have a team of software designers and developers that are experienced in insurance product development that can help companies navigate the complex world of insurance-tech. With our extensive experience in developing custom software solutions, we help conceptualize solutions that are made to create efficiencies and improve customer experiences. Whether you're looking to build a new app, automate your workflows, or enhance your digital capabilities, we can provide you with the expertise and support required for insurance software product development. Reach out to us today to learn how we can help your insurance company thrive in the digital era.