How to Build a Cloud-Based Insurance Rating Engine

- Overview

- What is an Insurance Rating Engine

- The key Components of a Cloud-based Rating Engine

- Programmatic Underwriting: Streamlining the Underwriting Process

- Back-end Infrastructure and APIs

- Data Storage Overview

- Cloud-based Storage Solutions

- On-premises vs. Cloud Storage

- Integrating Third-party Data Sources

- Advanced Algorithms and technologies

- Increased Efficiency

- Direct-to-Consumer Insurance Sales

- Scalability of Cloud infrastructure

- Cloud-Based Rating Engine Flexibility

- Programmatic Underwriting

- The Risks of Automation within Insurance

- Downsides of Programmatic Underwriting

- Solutions to Exposures and Fraud Risk

- Asymm’s Solutions and Services for Rating Engines and Cloud Infrastructure

Overview

In today's competitive insurance market, the ability to accurately calculate risk and provide timely quotes is critical for insurers looking to compete for new customers. A rating system plays a vital role in achieving this objective. By leveraging the power of cloud-based technologies and programmatic underwriting, insurance companies can build a robust insurance rating engine that facilitates direct-to-consumer sales, streamlines underwriting, and drives profitable growth. In this post, we’ll explore how to build a cloud-based insurance rating engine that combines data and technology to automate underwriting, reduce costs, and increase efficiency.

What is an Insurance Rating Engine?

An insurance rating engine is a critical component of a policy administration system (PAS) that calculates insurance premiums based on risk variables. A rating engine evaluates a wide range of factors such as age, loss history, location, credit score, and other key variables to determine the risk of insuring an individual, property, business. The more accurate the rating system, the more effective it is at predicting the likelihood of a claim, which in turn helps insurers offer competitive premiums that properly balance risk and profitability.

An insurance quoting system integrated with a rating engine allows insurers to provide automatic quotes tailored to the customers’ needs, and helps offer premium pricing in real-time. A cloud-based rating engine not only saves time for customers shopping around for an insurance policy, but also helps brokers and insurers underwrite more efficiently while reducing the risk of errors while mitigating insurance fraud through things like credit checks and identity verification.

A rating system can also facilitate the creation of new insurance products. By leveraging data and integrating third-party APIs, insurers can develop sophisticated rating engines that calculate premiums for emerging verticals of coverage. Through the use of big data sets, wearables and devices, data monitors, and other sources of valuable information, insurers can develop new products and calculate precise risk premiums. Moreover, the incorporation and utilization of new and improved data sources can help insurers identify new risks and opportunities for digitally distributed insurance, such as digital embedded insurance.

The key Components of a Cloud-based Rating Engine

To build a powerful insurance rating and quoting tool within the cloud, insurers must start by defining the data inputs required for the rating system to operate. These data inputs typically include information such as demographic inputs, credit information, loss history records, required limit information, and other relevant risk factors and variables that are specific to an insurance product and vertical. Gathering and processing this data is critical to ensure that the rating engine produces reliable and consistent results. Once insurance product development has been completed and the product application has been detailed out and the data inputs have been defined, the next step is to design the various components of the customer-facing front-end application and the back-end cloud-based rating engine. These components typically include:

Programmatic Underwriting: Streamlining the Underwriting Process

A rating engine enables programmatic underwriting, allowing insurers to ask qualifying questions automatically, which means that each applicant is assessed consistently, regardless of who is reviewing the application. This improves the accuracy of risk assessments by reducing the chances of certain fraud risks and ensuring that policies are priced appropriately. A programmatic underwriting approach also allows insurers to avoid bias and distribute risk more evenly across their portfolio, as the risk assessment is based on data and analytics rather than subjective factors.

Programmatic underwriting refers to the use of software algorithms to ask qualifying questions and determine a customer's risk profile. This technology-driven approach can help automate many of the underwriting tasks that were previously done manually, reducing the risk of errors or fraud, and increasing the efficiency of the underwriting process. By leveraging advanced algorithms, machine learning, and data analytics, programmatic underwriting enables insurers to make more accurate risk assessments and pricing decisions.

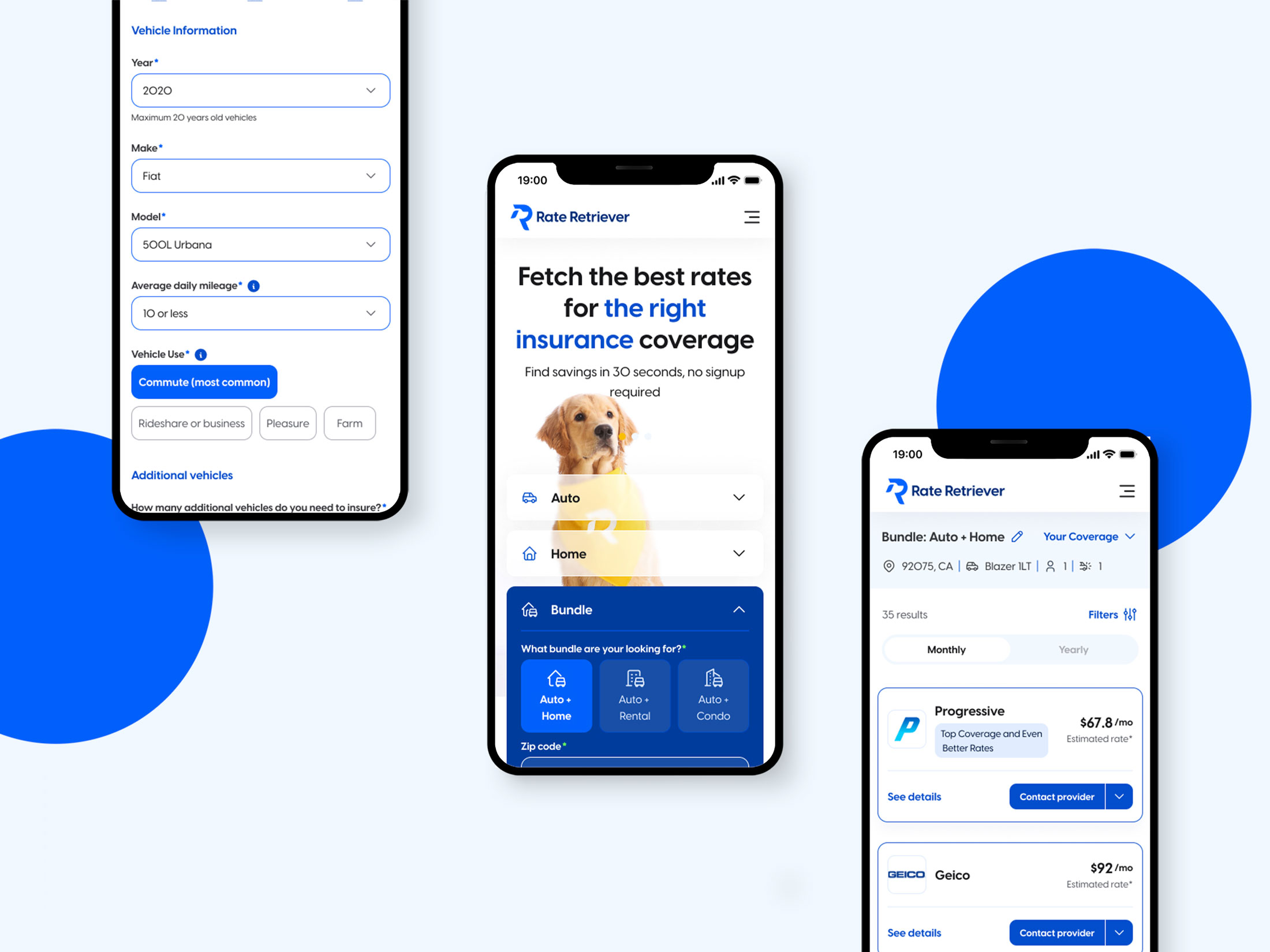

Once a premium is generated by a front-end application, the cloud-based rating engine communicates this information to the front-end application via an API (Application Programming Interface). The customer is then presented with a personalized quote, which they can review, compare with other options, and ultimately bind through a seamless online purchase flow. This digital experience not only streamlines the underwriting process but also offers customers greater convenience and transparency when obtaining insurance coverage. By embracing programmatic underwriting, insurance companies can enhance their customer experience, improve operational efficiency, and stay ahead in the competitive insurance landscape.

For the customer, programmatic underwriting on the front-end usually comes in the form of a user-friendly, progressive web application accessible online. A customer seeking insurance coverage will interact with a cloud-based rating system through this front-end application, which guides them through a series of questions and prompts to gather the necessary information. The rating engine then uses the collected data to calculate a premium based on the customer's unique risk profile.

Back-end Infrastructure and APIs:

Back-end infrastructure and APIs play a crucial role in modern insurance systems, especially when it comes to cloud-based rating engines. Let's break down these terms and concepts to make them easier to understand.

- Back-end Application: Think of the back-end application as the "brain" of the insurance system. It's the part that works behind the scenes, taking care of complex calculations, organizing data, and managing the overall structure of the system. The back-end application helps insurance companies generate quotes, assess risks, and manage underwriting processes efficiently.

- APIs (Application Programming Interfaces): APIs are like universal translators for different software systems. They provide a standardized way for these systems to "talk" to each other and exchange information. This communication is essential because insurance companies often need to integrate data from various sources, like credit bureaus or vehicle tracking systems, to make informed decisions.

In the context of an insurance system, the back-end infrastructure and front-end interface work together through APIs to deliver a seamless experience for customers seeking quotes and making online purchases. The back-end handles complex calculations, risk assessments, and data organization, while the front-end serves as the user interface that customers interact with.

APIs act as the bridge between the back-end and front-end, allowing them to communicate effectively and exchange information. When a customer requests a quote through the front-end interface, the API sends this request to the back-end, which processes the information, generates a quote based on the customer's data and the company's underwriting rules, and sends the quote back to the front-end through the API. The customer can then review the quote and proceed with the online purchase flow if they choose to accept it. By utilizing APIs to facilitate communication between the back-end and front-end, insurance companies can create a streamlined, efficient, and user-friendly experience for customers seeking insurance coverage online. This integration not only simplifies the quoting and purchasing process but also helps insurers adapt quickly to new data sources and technologies as they emerge.

Data Storage:

The insurance industry relies heavily on large amounts of data to assess risks, generate quotes, and manage claims. As technology advances, the amount of data generated and processed in real-time continues to grow. It's crucial to have a secure, scalable, and efficient database in place to handle this data. In this comprehensive guide, we'll explore various aspects of data storage and their importance in insurance and technology.

Cloud-based Storage Solutions:

Cloud-based storage solutions, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, are popular choices for managing large amounts of data. These services offer secure, scalable, and easily accessible storage options, allowing insurance companies to store and process vast amounts of information. They also provide flexibility, as insurers can easily scale their storage capacity up or down based on demand. Key features of cloud-based storage solutions include:

- Data Security: Cloud storage providers utilize advanced encryption methods and security protocols to protect sensitive data. This ensures that insurance companies can store customer and policy information with confidence.

- Data Redundancy: Cloud storage providers use redundant storage systems to prevent data loss in the event of hardware failures or other issues. This ensures that critical data is always available when needed.

- Data Analysis and Advanced Algorithm Development: A well-designed and properly set up database not only ensures smooth data storage and processing but also opens up opportunities for insurers to analyze their data and develop advanced algorithms.

This can help improve risk assessment, streamline underwriting processes, and even enhance customer experiences through personalized offerings. Some key aspects of data analysis include:

- Predictive Analytics: By analyzing historical data, insurance companies can identify patterns and trends that may indicate future risks, allowing them to make more informed decisions regarding policies and pricing.

- Machine Learning: Advanced algorithms can be developed using machine learning techniques to automate decision-making processes and improve overall efficiency.

On-premises vs. Cloud Storage:

While cloud-based storage solutions are becoming increasingly popular, some insurance companies still opt for on-premises storage, where data is stored and managed on local servers within the company's physical location. On-premises storage may provide a greater sense of control over data security but can be less scalable and more costly than cloud storage options. When choosing between on-premises and cloud storage, insurers should carefully consider factors such as cost, scalability, security, and compliance requirements.

Data Privacy and Compliance:

Data storage in the insurance industry is subject to various regulations and privacy laws, such as the General Data Protection Regulation (GDPR) in the European Union and the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Depending on the type of data being stored, Insurance companies must ensure that their data storage practices comply with these regulations to protect customer information and avoid potential breaches and penalties. In summary, data storage is a vital aspect of the insurance and technology landscape. By leveraging cloud-based storage solutions, insurers can effectively manage their growing data needs, adapt to fluctuations in demand, and unlock valuable insights for future improvements.

Integrating Third-party Data Sources

One of the most significant advantages of a cloud-based rating engine is its ability to leverage vast amounts of data to generate more accurate and reliable insurance premiums. This is achieved through the integration of third-party data sources and APIs, which provide insurers with access to a wealth of information beyond what’s available in their internal systems and the data that customers provide.

By integrating third-party data sources such as credit scores, driving records, and criminal history checks, insurers can gain a more comprehensive view of each customer's risk profile. These data sources can provide insights into factors that may not be immediately apparent, such as a customer's likelihood of default or driving history. By incorporating this information into their risk models, insurers can make more accurate and informed decisions about each customer's premium.

In addition to traditional data sources, cloud-based rating engines can also integrate emerging data sources and technologies such as social media and IoT devices. Social media data can provide insights into a customer's lifestyle, habits, and preferences, which can be used to inform risk assessments. Moreover, IoT devices such as smart homes and wearables can provide data on health, fitness, and home security, which can also be incorporated into risk models depending on the insurance product and risk indicators being used in a risk-pricing model. In terms of advanced risk model development, Machine learning algorithms can be developed to play a crucial role in analyzing the vast amounts of data generated by these third-party sources. Algorithms that leverage machine learning and artificial intelligence can identify patterns and correlations that would be difficult or impossible for humans to detect, allowing insurers to generate more accurate and reliable risk scores.

Advanced Algorithms and Technologies:

While simple cloud based rating engines can rely on rule-based calculations to determine premiums, advanced algorithms are an option for more sophisticated rating engine projects. Mathematical models can be developed to leverage various data inputs and produce a risk score, which plays a part in determining an insurance premium. Building accurate and effective algorithms requires a deep understanding of the risk factors involved, as well as access to large amounts of high-quality data. By leveraging machine learning and other advanced techniques, insurers can develop algorithms that are more sophisticated and precise, resulting in more accurate and profitable premiums.

Increased Efficiencies with Cloud Rating Engines:

A cloud-based rating engine can significantly increase efficiency by automating the insurance rating and underwriting process. By leveraging user inputs, data, and automated calculations, insurers can generate insurance premiums automatically, reducing the need for heavy human oversight. For more sensitive and higher risk classes of insurance, systems can be designed in coordination with underwriters and risk experts to flag certain quotes and policies to maintain underwriting standards, resulting in faster processing times and reduced cost through either full or semi-automation of quote issuance and policy generation.

Direct-to-Consumer Insurance Sales:

A rating engine facilitates direct-to-consumer insurance sales by enabling customers to obtain automatic quotes and purchase policies online. An online rater and insurance purchase flow eliminates the need for traditional sales channels, such as brokers or agents, reducing costs and increasing customer convenience. A web-based insurance experience also streamlines the insurance application process, reducing the time it takes to obtain a quote and increases customer satisfaction.

Scalability of Cloud Infrastructure:

A cloud-based rating engine can scale easily to accommodate changes in demand. As the number of requested quotes increases, a programmatic quoting engine can adapt to handle the additional workload. Cloud architectures have built in scalability features that manage infrastructure and cloud computing resources to accommodate spikes in volume and heavy traffic. This flexibility ensures that insurers can meet the needs of their customers without sacrificing quality and urgency. For example, customers that are looking to get a quote on a vehicle or a general liability policy shouldn’t have to wait for a broker to call them back and fill out a PDF-based application. Instead they can rely on an automated web-based solution to provide them with the quote and coverage they need.

Cloud-Based Rating Engine Flexibility:

A cloud-based rating engine offers unparalleled flexibility, making it an ideal choice for insurance companies looking to stay competitive in today's dynamic market. One of the key benefits is the ability to generate and compare multiple quotes for customers simultaneously. This empowers consumers to evaluate different policies, understanding the advantages of each option in terms of coverage, deductibles, and premiums. A J.D. Power 2019 Insurance Digital Experience Study highlights the importance of digital experiences in customer satisfaction and the increasing preference for online quoting experiences.

This flexible system also enables insurers to rapidly adapt to changing market conditions by customizing their rating engine to introduce new products or adjust pricing to remain competitive. For instance, PwC's 22nd Annual Global CEO Survey found that 85% of insurance CEOs believe that technology will significantly change the way they do business in the next five years. By utilizing a cloud-based rating engine, insurers can tweak key variables and efficiently roll out new offerings or pricing adjustments, ensuring they stay ahead of the curve.

In summary, the flexibility offered by cloud-based rating engines ensures that insurance companies can keep pace with the ever-evolving demands of the market while delivering superior products and services to their customers. This technology-driven approach ultimately leads to more satisfied customers and a stronger competitive edge for insurers.

The Risks of Automation Within Insurance

Downsides of Programmatic Underwriting

Although programmatic underwriting can provide significant advantages, there are also some drawbacks insurers need to consider. One potential downside is that some high-risk individuals may slip through the cracks. Programmatic underwriting relies on rules, data, and algorithms to assess risk, which can result in some individuals being misclassified or underpriced. This can lead to insurers underestimating the risk associated with certain profiles, policies, and even portfolios, resulting in potential losses. Some individuals may intentionally provide false information to obtain lower premiums, which can lead to fraudulent or mis-priced claims. Insurers must carefully monitor their programmatic underwriting systems to ensure that they are accurately assessing risk and identifying fraudulent insureds before problems arise. To counter this, system development must be carefully crafted with expert oversight and constant monitoring by seasoned underwriters.

Solutions to Exposure and Fraud Risk

Moreover, An insurance rating system can leverage various technologies to identify potential fraud and flag high-risk insureds for underwriters to review. By employing advanced analytics, machine learning, and data mining techniques, insurance companies can detect patterns and anomalies that may indicate fraudulent activities or high-risk behaviors. Here are some ways technology can help in identifying fraud and risk:

- Anomaly Detection: Data mining techniques can be used to identify outliers or unusual behaviors that deviate from normal patterns. For example, a study conducted by the Coalition Against Insurance Fraud found that 5-10% of insurance claims are fraudulent. By utilizing anomaly detection algorithms, insurers can flag cases that deviate from regular patterns, such as a sudden increase in claims from a particular area or an unusually high number of claims from a single policyholder.

- Social Network Analysis: By examining relationships and connections between insureds, insurance companies can identify potential fraud rings or organized criminal activities. According to the Federal Bureau of Investigation (FBI), insurance fraud costs the US more than $40 billion per year. Social network analysis can reveal suspicious patterns, such as multiple claims from the same group of individuals or connections between seemingly unrelated insureds, helping to uncover complex fraud schemes.

- Geospatial Analysis: Insurance companies can use geospatial data to identify potential fraud or high-risk areas. A study by the Insurance Research Council found that insurance fraud rates are higher in urban areas compared to rural locations. By leveraging geospatial analysis, insurers can identify locations with unusually high claim rates or a concentration of high-risk insureds, which can then be flagged for further investigation. This targeted approach allows insurers to allocate resources more effectively and reduce losses due to fraud.

Asymm’s Solutions and Services for Rating Engines and Cloud Infrastructure

At Asymm, our team of product designers and engineers have extensive experience in developing custom cloud based insurance rating engines that meet the unique needs of insurers and brokerage groups alike. With our expertise in outsourced web application development, cloud computing, data analysis, custom API development, and API integrations, we can help insurance companies build a rating engine and programmatic underwriting capabilities that improves their operations and enhances their customer experience. Whether you are looking to integrate third-party data sources, develop programmatic underwriting capabilities, or streamline your quoting and policy issuance processes, we can provide ideas, designs, and solutions that meet your needs. Contact us to schedule an in-depth conversation about your insurance software development needs.