Embedded Insurance: how it works and how your business can leverage it

Embedded insurance is a relatively new concept that’s gained significant traction in recent years. With a projected growth rate of 20.7% from 2022 to 2029, embedded insurance offers businesses an exciting opportunity to offer insurance products as part of their existing products and services. By seamlessly integrating insurance products into the customer's purchasing journey, companies can establish themselves as a one-stop-shop for diverse customers' needs and create new digital service based revenue streams. In this post, we’ll explore what embedded insurance is, how it works, real-world examples and why it could be a product worth developing for your business.

What is Embedded Insurance?

In today's fast-paced digital age, convenience is key. Rather than having to search for insurance policies separately and navigate through different providers' websites and apps, embedded insurance offers customers a seamless experience by integrating insurance products into the purchasing process of other products and services.

For example, when you purchase a new phone, the option to add insurance for the device is often presented as part of the checkout process. Similarly, when you rent a car, you may have the option to add on insurance coverage for the duration of your rental. This coupling of the primary product or service with the insurance policy is tailored to meet the exact needs of the consumer.

Embedded insurance is a part of a larger trend known as embedded finance, which aims to make financial products and services more accessible and integrated into everyday life. With embedded finance, non-financial companies can offer financial products and services to their customers, providing them with added convenience and value.

So, How Does Embedded Insurance Work?

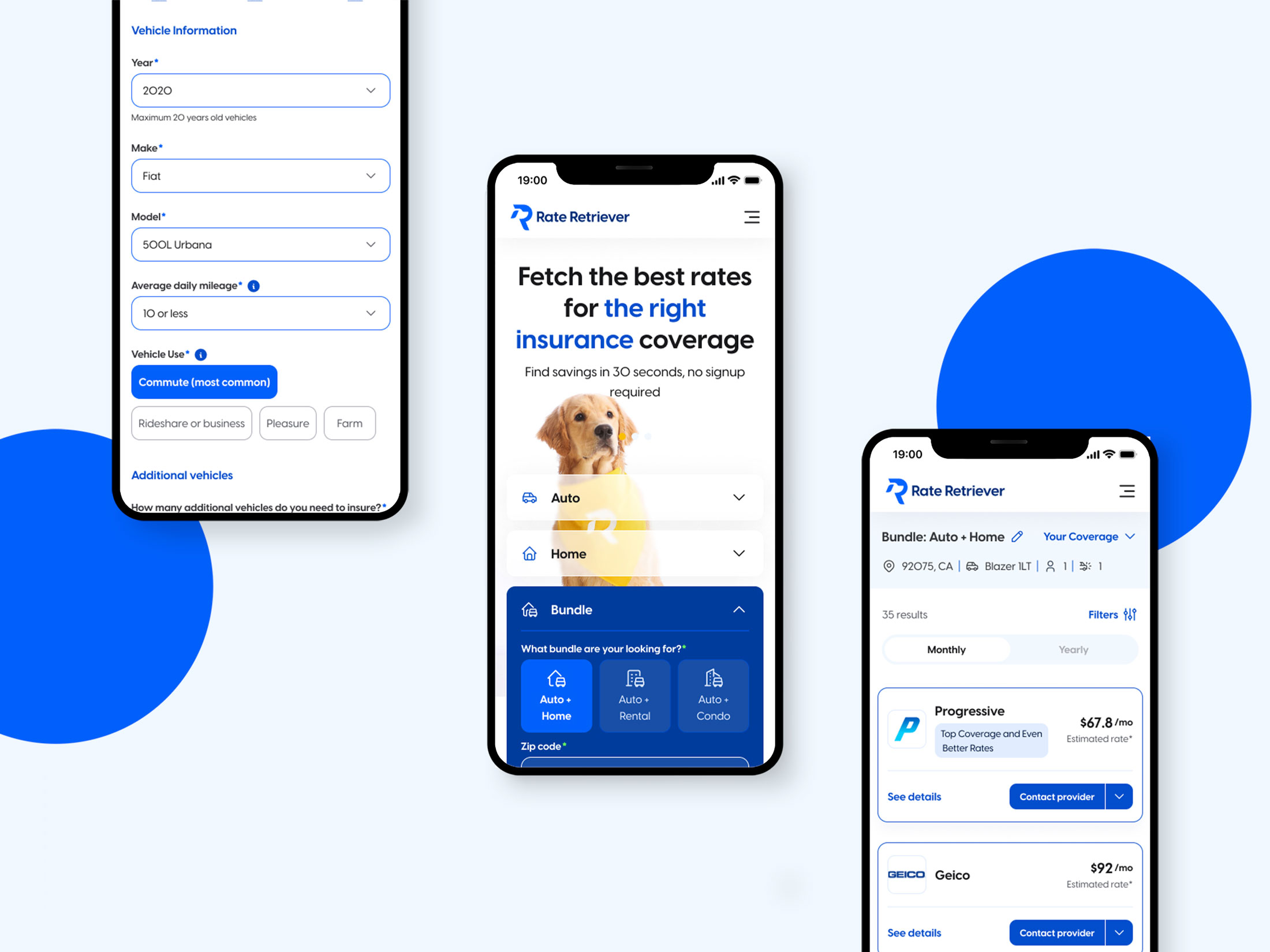

Unlike traditional insurance buying processes that are tedious and disjointed, embedded insurance often works by integrating insurance APIs within a third-party system seamlessly, providing customers with the convenience of buying insurance at the time of their initial purchase. Instead of requiring people to navigate to a separate insurance provider's website or app, an embedded experience seamlessly offers insurance products as an add-on to the primary product or service that a consumer is purchasing. The embedded insurance process is designed to be quick, simple, and straightforward. Customers are presented with an insurance quote or offering during the primary checkout process, and they can easily obtain a policy and provide the necessary information to purchase it without leaving the business's website or app. Within this embedded process, the insurance policy is then generated and digitally delivered to the customer, all without any additional steps, hassle, and time taken.

Examples of Embedded Insurance

Embedded travel insurance

Travel insurance is one of the most common examples of embedded insurance that people encounter in their daily lives. When purchasing a plane ticket online, customers are often offered travel insurance as part of their checkout process. Embedded travel insurance offers a range of benefits such as trip cancellation, emergency medical assistance, and lost luggage coverage. Embedded travel insurance integrations saves people time and effort while also increasing the likelihood that they’ll purchase the coverage in the first place. According to a recent survey, 55% of people who purchased travel insurance got it through a travel website like Expedia, instead of through an insurance platform.

Embedded insurance offered at the point of sale

Another example of embedded insurance is bicycle insurance that’s available for purchase at a POS (Point of sale), which is often offered as an add-on when purchasing a new bike at a retailer. By integrating insurance into the checkout process, customers can easily insure their bike against theft, accidental damage, and other risks that come with bike ownership through dedicated policy that’s designed for their exact use case and downside risks.

Embedded Renters Insurance

Renters insurance has also started to take an embedded approach. Renters insurance is now also being offered through rent payment portals. Property management companies and landlords can offer the option to purchase renters insurance as part of the payment process, making it easy for tenants to obtain the insurance coverage they need. These integrations are made possible through custom API development, which allows for the integration of insurance offerings directly into existing payment platforms.

Embedded digital currency insurance

Several cryptocurrency exchange platforms offer another example of embedded insurance. As cryptocurrency transactions become more prevalent, the need for insurance protection against hacking, theft, or loss of private keys has become more critical. Many cryptocurrency exchanges have partnered with insurance companies to offer insurance coverage to their customers, and some exchanges even require customers to purchase insurance as a prerequisite for opening an account. This type of coverage not only protects the exchange platform's reputation and credibility but also provides peace of mind to the customers, knowing that their digital assets are safeguarded against unexpected events.

Ultimately, the integration of insurance products into the customer's purchasing journey presents a win-win situation for both businesses and the customer.

The Benefits of Embedded Insurance

Increased Revenue for Businesses

Embedded insurance can be a source of additional revenue for businesses. According to the latest data, the embedded insurance industry's revenue is expected to rise from $56,979.8 million in 2022 to $161,598.3 million by 2029.

By offering insurance products as part of their purchasing journey, businesses can earn commissions or fees from insurance providers. This can be a valuable source of revenue, particularly for businesses that are looking to innovate, develop new products, and expand top-line revenue. By 2030, embedded insurance could account for over $700 billion in Gross Written Premiums, or 25% of the total market in property alone.

Embedded insurance, valued at the current InsurTech multiples, represents over $3 trillion opportunity of market value, which represents a tremendous opportunity for businesses to capture a share of this growing market and expand their top-line revenue. With the potential for significant value creation, businesses that prioritize embedded insurance as part of their overall strategy are likely to see substantial returns in the years to come.

Enhanced Customer Experience

Embedded insurance can significantly improve the customer experience by making the process of purchasing insurance more convenient. By offering insurance products as part of the checkout process, businesses can eliminate the need for customers to navigate to a separate insurance website and complete a lengthy application process for an insurance product that might not fit their exact need. The convenience of embedded insurance products can make the buying journey smoother and more efficient, leading to increased conversion, customer satisfaction, and loyalty. According to a recent survey by the FintechTimes, 71% of surveyed people said that they would be interested in receiving embedded insurance products as part of their purchase journey.

Affordable Protection

Embedded insurance provides customers with an additional layer of protection against unforeseen events. For example, travel insurance can cover unexpected flight cancellations, medical emergencies, or lost luggage, providing customers with peace of mind when they travel. Similarly, embedded insurance for online purchases can protect customers from fraud or unauthorized purchases, ensuring that they’re not left with the financial burden of resolving these issues on their own. This added layer of protection can be a significant benefit for customers, making them feel more secure in their purchases.

How to develop embedded insurance products

Embedded insurance is a game-changer for the insurance industry and provides a tremendous opportunity for businesses to create new revenue streams and add on valuable digital financial services to their primary product. While creating an embedded insurance product is not easy, there are a few key ways to engage in relationships to drive successful product development.

How to develop an embedded insurance product

There are multiple ways to develop an embedded insurance product but one of the first steps is identifying the various channels that the primary product or service is sold through. For example, an e-commerce purchase of a bed frame will have a much different embedded insurance approach than a purchase of a nice watch at a department store. In both of these cases, the manufacturer of the primary product will have to identify the best channel to target embedded sales through, and start building relationships and technology to support the product development process, most notably technology.

A few of the proven software tactics for offering embedded insurance solutions include:

- Embedded purchase flows within the primary product journey

- API development and integrations to support checkout add-ons

- White labeling online insurance platforms

Embedded purchase flows

By integrating insurance options into the primary product journey, businesses can streamline the purchasing process for their customers. For example, by integrating travel insurance into the booking process of a vacation rental, customers can easily purchase insurance coverage to protect their trip without having to navigate to a separate website or application. The vacation rental company can customize the insurance products to meet the specific needs of their customers, such as trip cancellation, trip interruption, or medical emergencies.

Embedded API development

By integrating insurance APIs, businesses can offer customers insurance add-ons during the checkout process, providing customers with a convenient purchasing experience. API development also offers businesses the flexibility to customize insurance products to meet their specific needs, such as offering options that are tailored to their industry or customer base. For example, a rental car company can customize the insurance products to meet the specific needs of their customers, such as offering options that cover different types of damages or provide additional roadside assistance.

White labeling insurance platforms

White-labeling insurance products can make the process even easier, and it’s a cost-effective approach that offers added value to customers. White-labeling is a concept where a company creates a product or service and then rebrands and sells it under another company's name. For example, a pet supply store may offer white-label pet insurance to help their customers protect their pets' health. The benefit of white-labeling is that it saves a company a lot of work and can offer added value to their existing customer base.

Using a custom software development company for embedded insurance development

At Asymm, we provide embedded insurance software development services to businesses looking to enhance their customer experience and generate additional revenue streams.

Our embedded insurance services first start with analyzing the customer purchasing journey of your products and services and analyzing how embedded insurance through custom software product development can be executed appropriately. To find out more, get in touch to discuss how we can help you create a branded insurance product as part of your product or service offering.